How to Calculate Your Home Equity: A Step-by-Step Guide

Introduction

Understanding your home equity is essential for making informed financial decisions. Home equity represents the portion of your property that you truly own, and it can be a valuable asset for funding various expenses, from home improvements to debt consolidation. In this comprehensive guide, we’ll walk you through the process of calculating your home equity step by step, and provide tips on how to maximize and leverage it effectively.

What is Home Equity?

Definition of Home Equity

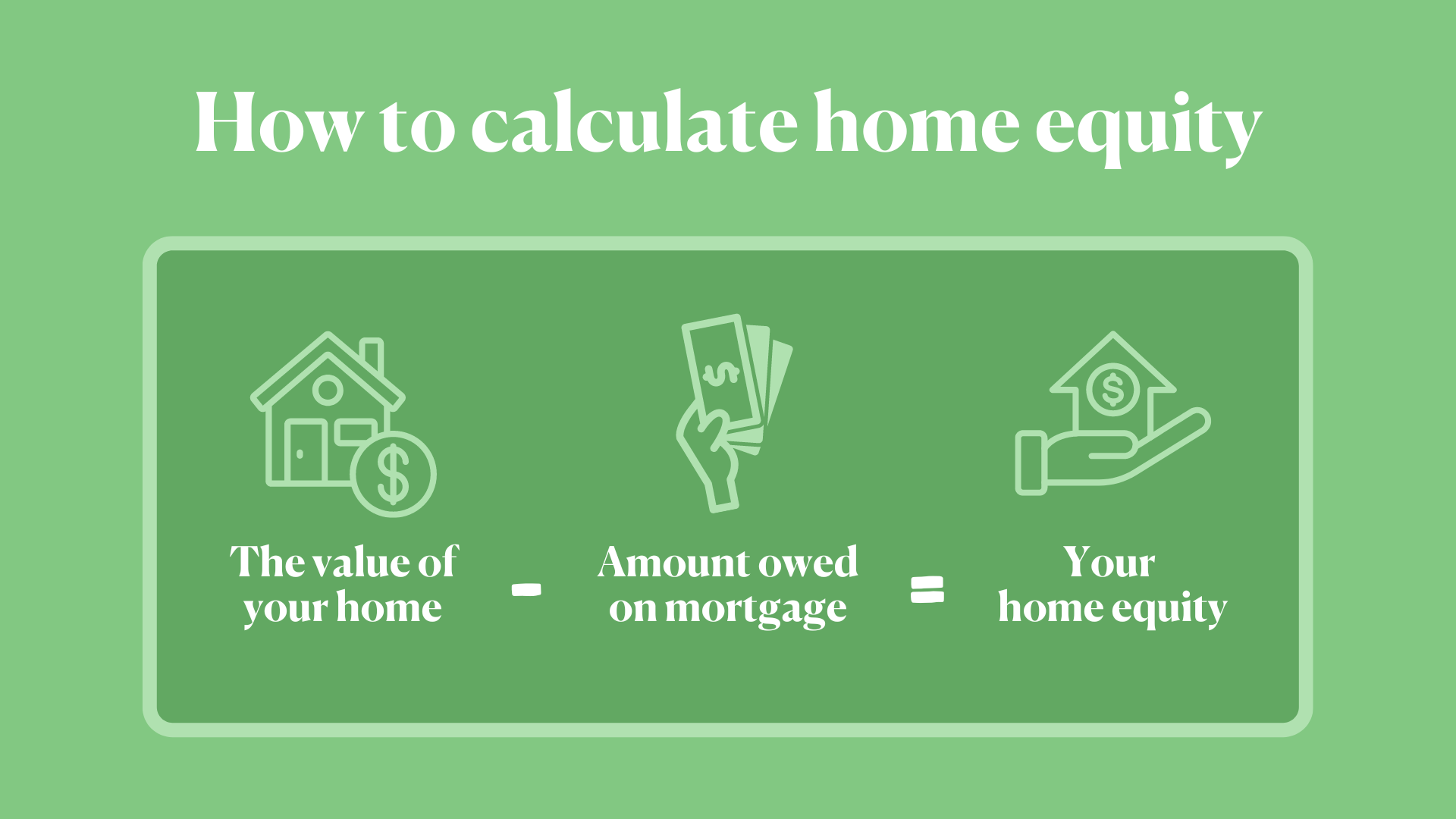

Home equity is the difference between the current market value of your home and the outstanding balance on your mortgage. It represents the portion of your home that you own outright, and it can be an important financial resource for homeowners.

Importance of Knowing Your Home Equity

Knowing your home equity is crucial for several reasons:

- Financial Planning: Understanding your equity helps you make informed decisions about refinancing, selling, or taking out a home equity loan or line of credit.

- Borrowing Power: Home equity can be used as collateral for loans, providing you with access to funds for various needs.

- Net Worth Calculation: Home equity contributes to your overall net worth, giving you a clearer picture of your financial health.

Step-by-Step Guide to Calculating Home Equity

Step 1: Determine Your Home’s Current Market Value

The first step in calculating your home equity is to determine the current market value of your home. There are several ways to estimate this value:

- Professional Appraisal: Hiring a professional appraiser provides the most accurate estimate of your home’s value. Appraisers consider factors such as location, condition, and recent sales of similar properties in the area.

- Comparative Market Analysis (CMA): Real estate agents can perform a CMA by analyzing recent sales of comparable homes in your neighborhood.

- Online Valuation Tools: Various websites offer free home valuation tools that use public data and algorithms to estimate your home’s value. While convenient, these estimates may not be as precise as a professional appraisal.

Step 2: Find Your Outstanding Mortgage Balance

Next, you’ll need to determine the outstanding balance on your mortgage. You can find this information by:

- Reviewing Your Mortgage Statement: Your monthly mortgage statement will show the remaining principal balance on your loan.

- Contacting Your Lender: Reach out to your mortgage lender for the most up-to-date information on your outstanding balance.

- Online Account Access: If your lender offers online account access, you can log in to view your mortgage balance.

Step 3: Calculate Your Home Equity

Once you have both the current market value of your home and the outstanding mortgage balance, you can calculate your home equity using the following formula:

For example, if your home is worth $400,000 and you owe $250,000 on your mortgage, your home equity is $150,000.

Step 4: Monitor Changes in Home Equity

Home equity can change over time due to factors such as mortgage payments, property value fluctuations, and home improvements. It’s important to monitor these changes regularly to stay informed about your financial position.

Tips for Maximizing Your Home Equity

1. Make Extra Mortgage Payments

Making additional payments towards your mortgage principal can accelerate the reduction of your loan balance, thereby increasing your home equity more quickly. Consider making biweekly payments or adding extra amounts to your monthly payments.

2. Invest in Home Improvements

Strategic home improvements can increase your property’s market value and boost your equity. Focus on projects with high return on investment, such as kitchen and bathroom remodels, energy-efficient upgrades, and curb appeal enhancements.

3. Refinance to a Shorter-Term Loan

Refinancing your mortgage to a shorter-term loan can help you build equity faster. While monthly payments may be higher, more of each payment goes towards the principal, reducing the loan balance more quickly.

4. Pay Down High-Interest Debt

Reducing high-interest debt can improve your overall financial health, allowing you to allocate more funds towards building home equity. Lowering your debt-to-income ratio can also make you eligible for better refinancing terms.

5. Avoid Using Home Equity for Non-Essential Expenses

While home equity can be a valuable financial resource, it’s important to use it wisely. Avoid tapping into your equity for non-essential expenses, such as vacations or luxury purchases, as this can deplete your financial cushion.

How to Leverage Home Equity

Home Equity Loans

A home equity loan allows you to borrow a lump sum of money against your home’s equity. With fixed interest rates and fixed monthly payments, it is suitable for large, one-time expenses like home renovations or debt consolidation.

Home Equity Line of Credit (HELOC)

A HELOC provides a revolving line of credit that you can draw from as needed. With variable interest rates and flexible borrowing options, it is ideal for ongoing or variable expenses such as home repairs or education costs.

Cash-Out Refinance

Cash-out refinancing involves replacing your existing mortgage with a new one for a higher amount, allowing you to receive the difference in cash. This option can be useful for funding large projects or paying off high-interest debts.

Conclusion

Calculating your home equity is a straightforward process that involves determining your home’s current market value and subtracting your outstanding mortgage balance. By understanding and monitoring your home equity, you can make informed financial decisions and leverage this valuable asset for various needs. Remember to maximize your equity through extra mortgage payments, strategic home improvements, and responsible financial management. With careful planning and smart use of home equity, you can achieve your financial goals and enhance your overall financial well-being.