Building a Diversified Investment Portfolio

Introduction

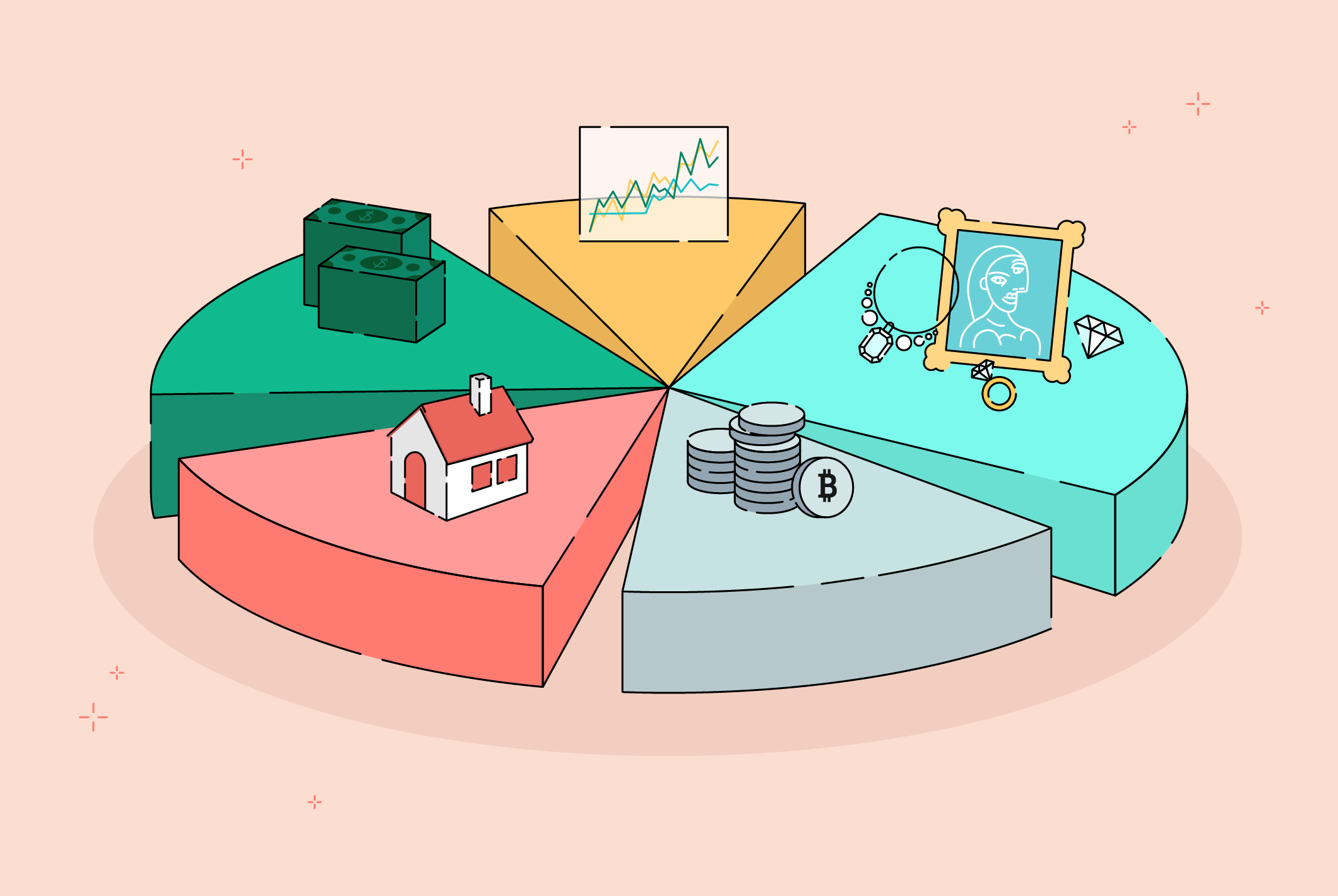

In the realm of investing, diversification is a fundamental principle that can help mitigate risk and enhance potential returns. By spreading your investments across various asset classes, industries, and geographical regions, you can create a balanced portfolio that is better equipped to weather market fluctuations. This article provides valuable information, tips, and guidelines on how to build a diversified investment portfolio and achieve your financial goals.

Understanding Diversification

Diversification involves allocating your investment funds across a wide range of assets to reduce the impact of any single investment’s poor performance on your overall portfolio. The goal is to create a mix of investments that respond differently to market conditions, thereby balancing risk and return.

The Benefits of Diversification

Diversification offers several key benefits:

- Risk Reduction: By investing in a variety of assets, you can lower the overall risk of your portfolio. If one investment performs poorly, the positive performance of others can offset the losses.

- Potential for Higher Returns: Diversification allows you to capture returns from different sectors and asset classes, which can enhance your overall portfolio performance.

- Smoother Ride: A diversified portfolio tends to be less volatile, providing a smoother investment experience compared to a concentrated portfolio.

Key Components of a Diversified Portfolio

1. Asset Classes

Diversifying across different asset classes is essential. The main asset classes include:

- Stocks: Equities offer the potential for high returns but come with higher volatility. Consider investing in a mix of large-cap, mid-cap, and small-cap stocks to spread risk.

- Bonds: Fixed-income securities, such as government and corporate bonds, provide stable returns and lower risk compared to stocks. They are an excellent way to balance a high-risk portfolio.

- Real Estate: Real estate investments can provide steady income and potential appreciation. Real Estate Investment Trusts (REITs) are a popular way to gain exposure to this asset class.

- Commodities: Investing in commodities like gold, silver, and oil can provide a hedge against inflation and market downturns.

2. Industry Sectors

Within each asset class, it’s crucial to diversify across different industry sectors. For example, within your stock investments, consider allocating funds to technology, healthcare, finance, consumer goods, and industrial sectors. This approach ensures that your portfolio is not overly exposed to any single industry.

3. Geographic Regions

Geographic diversification involves investing in markets outside your home country. By including international stocks and bonds in your portfolio, you can benefit from the growth potential of emerging markets and reduce the risk associated with a single country’s economic conditions.

Steps to Build a Diversified Portfolio

1. Define Your Investment Goals

Before you start building your portfolio, clearly define your investment goals. Are you saving for retirement, a down payment on a house, or your children’s education? Your goals will influence your asset allocation and investment strategy.

Tips:

- Write down your financial objectives and time horizon.

- Determine your risk tolerance and how it aligns with your goals.

2. Assess Your Current Portfolio

Evaluate your existing investments to identify any gaps or overexposures. Assess the performance, risk level, and asset allocation of your current portfolio to determine areas that need adjustment.

Tips:

- Use portfolio analysis tools to get a comprehensive view of your investments.

- Identify areas where you need to add diversification or reduce concentration.

3. Choose the Right Investment Mix

Based on your goals, risk tolerance, and existing portfolio, choose the right mix of asset classes, industry sectors, and geographic regions. Aim for a balanced allocation that aligns with your investment objectives.

Tips:

- Consider using a core-satellite approach, where the core of your portfolio consists of diversified, low-cost index funds, and the satellite investments are higher-risk, higher-reward assets.

- Use target-date funds for retirement savings, as they automatically adjust the asset allocation based on your retirement date.

4. Regularly Rebalance Your Portfolio

Market conditions and investment performance can cause your portfolio’s asset allocation to drift over time. Regularly rebalancing your portfolio ensures that it stays aligned with your investment goals and risk tolerance.

Tips:

- Set a schedule to review and rebalance your portfolio, such as quarterly or annually.

- Rebalance by selling overperforming assets and buying underperforming ones to restore your desired allocation.

5. Stay Informed and Adapt

The investment landscape is constantly evolving, and staying informed about market trends and economic developments is crucial. Be open to adapting your investment strategy based on new information and changing conditions.

Tips:

- Follow reputable financial news sources and market analysts.

- Attend investment seminars, webinars, and workshops to enhance your knowledge.

- Consider consulting with a financial advisor for personalized guidance.

Common Pitfalls to Avoid

1. Over-Diversification

While diversification is essential, over-diversifying can dilute your returns and make it difficult to manage your portfolio effectively. Strive for a balance between diversification and concentration.

Tips:

- Focus on quality investments rather than spreading your funds too thin.

- Avoid investing in too many similar assets or sectors.

2. Chasing Performance

It’s easy to be tempted by high-performing assets, but chasing performance can lead to poor investment decisions. Stick to your long-term strategy and avoid making impulsive changes based on short-term market movements.

Tips:

- Review your investment plan regularly and make adjustments based on your goals and risk tolerance, not recent performance.

- Stay disciplined and avoid making emotional decisions.

3. Neglecting Costs

Investment costs, such as management fees and transaction costs, can eat into your returns. Pay attention to the costs associated with your investments and strive to minimize them.

Tips:

- Choose low-cost index funds or ETFs for the core of your portfolio.

- Be mindful of transaction costs and avoid excessive trading.

Conclusion

Building a diversified investment portfolio is a key strategy for achieving your financial goals while managing risk. By spreading your investments across various asset classes, industry sectors, and geographic regions, you can create a balanced portfolio that is better equipped to navigate market fluctuations. Remember, successful investing requires patience, discipline, and continuous learning. Stay focused on your long-term objectives, regularly review and rebalance your portfolio, and seek professional advice when needed. With the right approach, you can build a diversified portfolio that helps you achieve financial independence and peace of mind.